Customer Transparency

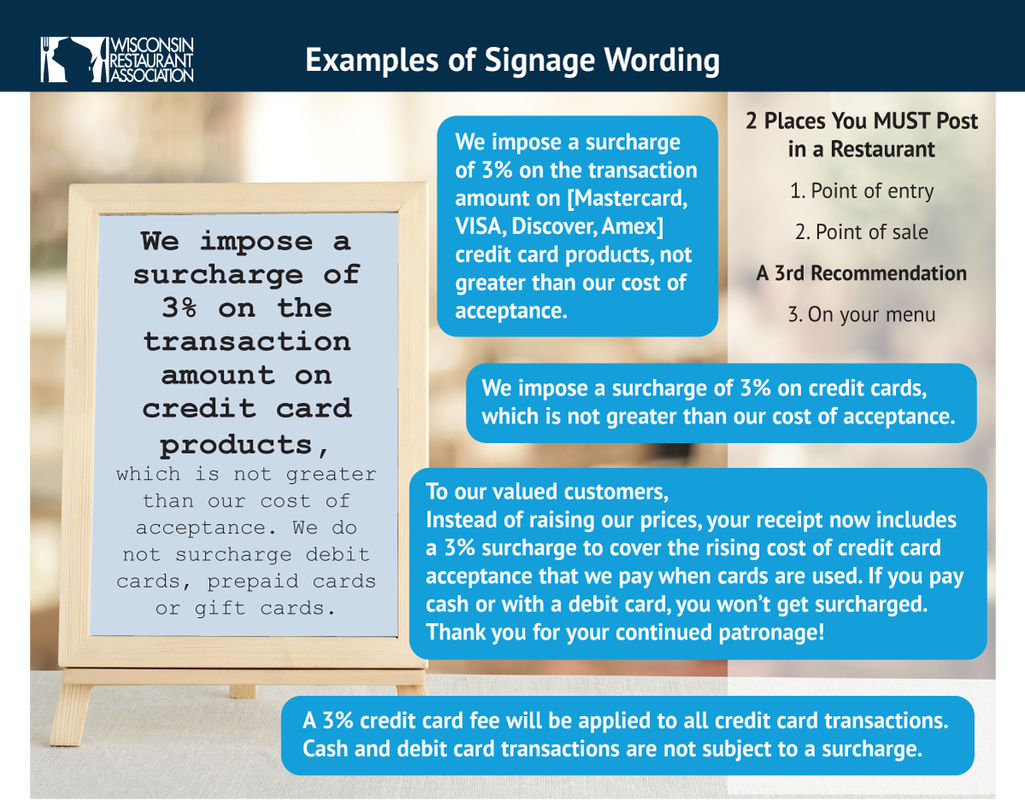

Clear and conspicuous notice must be communicated prior to the sale:

Clear and conspicuous notice must be communicated prior to the sale:

|

Retail & Most Businesses

Signage must be posted at store entry and at the point of sale. |

Restaurants

Notice must be printed on menus and on signage in the customer service area. |

Online, Kiosks & Apps

Notice must be on the homepage and at checkout (before processing the transaction). |

Telephone Orders

Verbal notice must be given to the customer prior to processing the transaction. |

The Difference

|

Surcharge A fee applied to a published price when paying with a credit card. Published prices are the price paid with cash or debit card. The extra cost is ADDED to the advertised price. |

Cash Discount A discount on a published price when paying in cash. Published prices are the price paid with credit or debit card. You DEDUCT the discount from the advertised price. |

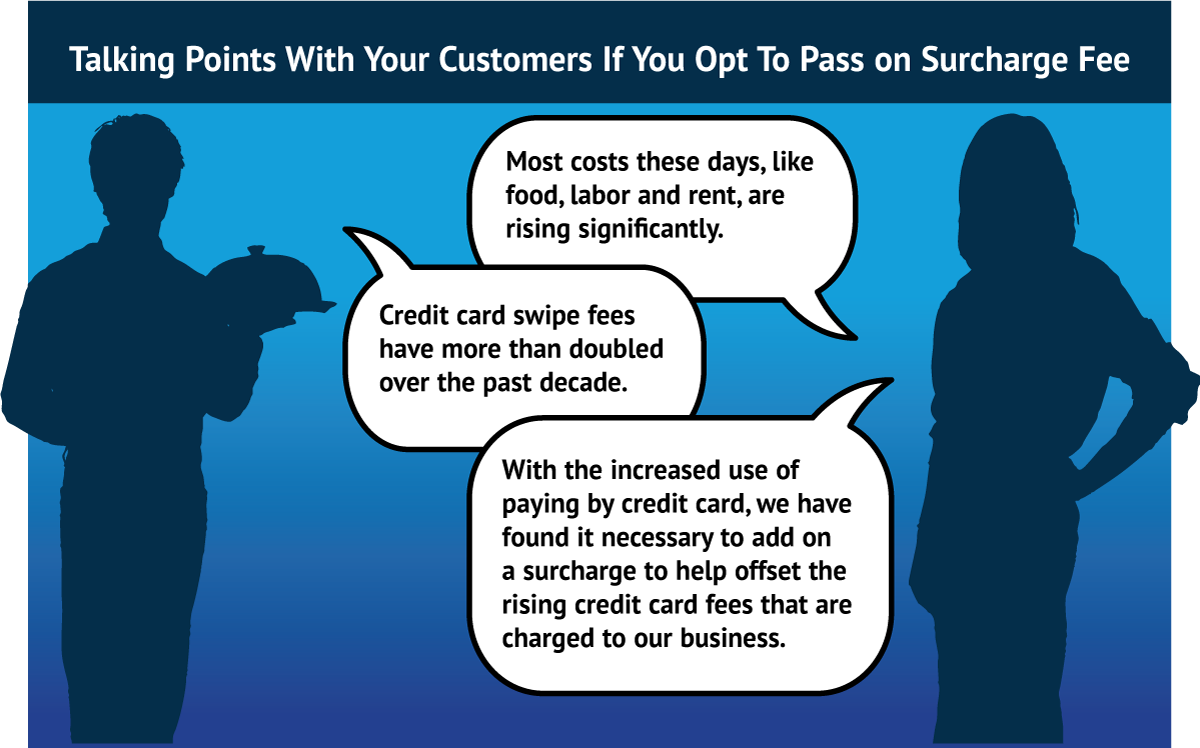

The Bottom Line on the Surcharge Rules & Regulations

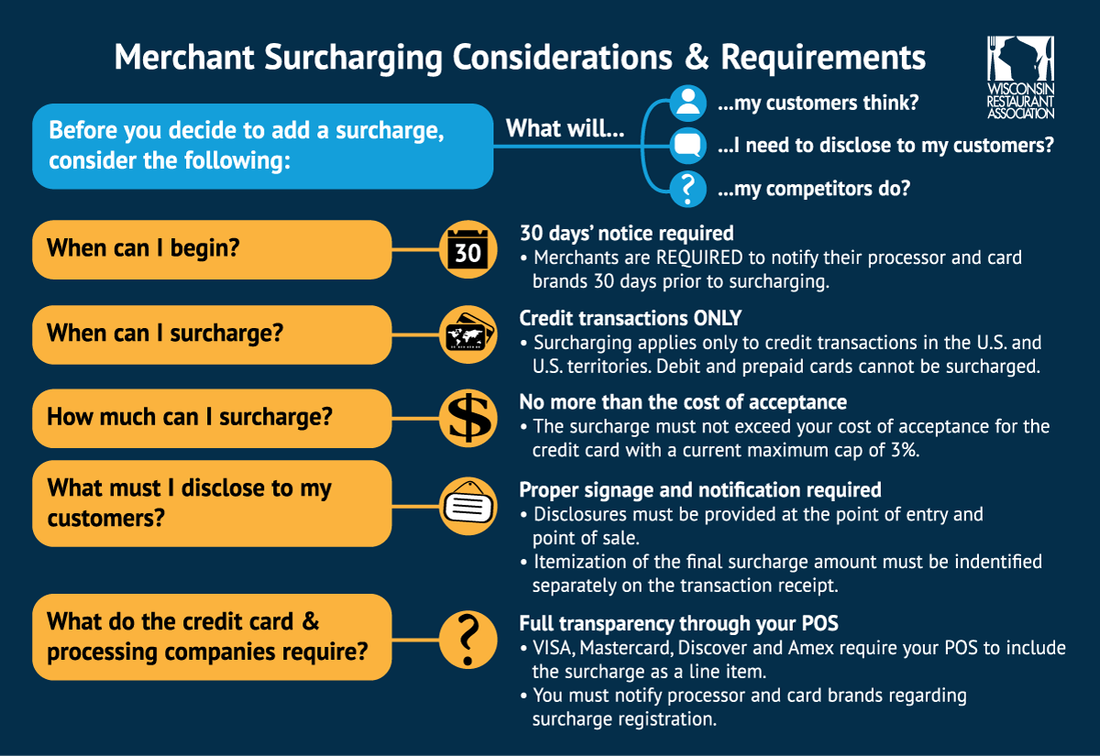

Businesses cannot profit from surcharge fees. They can only offset some of the fees they pay to credit card networks and processors. And cards have caps on what you can apply for a surcharge.

Businesses cannot profit from surcharge fees. They can only offset some of the fees they pay to credit card networks and processors. And cards have caps on what you can apply for a surcharge.

|

Surcharge Caps The maximum that you can currently charge is 3%. You cannot charge more than what your cost of acceptance is. |

Convenience Fees An additional charge passed on to the customer for things like orders placed and paid for online. The convenience fee is not charged for using a credit card, but instead for the ease and ability of ordering online. Convenience fees are normally a flat fee or a small percentage of the total payment. And you must clearly communicate the existence of such a fee before the completion of the transaction. |

Surcharges Can be imposed ONLY when a customer uses a credit card. It’s regulated by card brand rules. And it’s limited to the amount that the business is paying to process that credit card. |

|

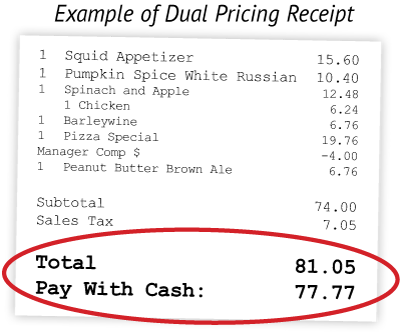

Have you Heard of Dual Pricing?

This is a different spin on how to offer a cash discount. To be compliant, you must advertise the credit card price to your customers. This means increasing your menu prices so the cost for your menu items include the credit card fee. While similar to a surcharge, the difference is that with dual pricing you do not add on a surcharge at the end. This does require a sophisticated POS system which isn’t possible with all providers. |

Examples of What You CANNOT Do

|

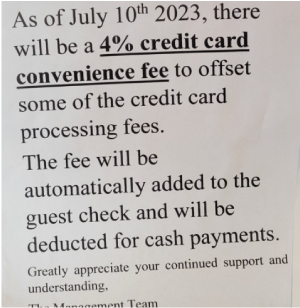

This example is not transparent. It implies that a surcharge will be added without outright saying it.

|

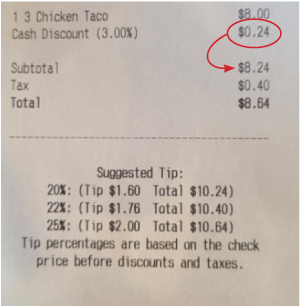

If you wish to offer a cash discount, you cannot add the “cash discount” into the “total” price. That then is a surcharge.

|

You cannot label it a “convenience fee” in order to receive more than the 3% that’s allowed for “surcharges”. This should be labeled a “surcharge” and capped at 3%.

|

|

Bottom Line: What happens if you DON’T follow the rules?

Disregarding the rules means credit card companies can impose hefty fines and terminate your business’s merchant account. If you don’t display proper signage, you will be violating consumer protection laws and regulations regarding transparency and fair trade which could lead to customers filing complaints that could result in legal action against you. |

You must inform your processor and card brands 30 days prior to your intent to add surcharges.