Popular Topics

The WRA is committed to providing the best quality, value and services to meet your needs. We strive to keep our members and the public informed about critical issues that impact the foodservice and hospitality industry. Through national and local resources the WRA gathers information to provide current news, trends, regulatory changes and operational guidance.

Featured Topics

Third-party Delivery LawA third-party delivery law went into effect on July 1, 2024. This law puts in place measures relating to how third-party delivery companies interact with restaurants to curb certain third-party delivery company business practices that are harmful and costly to restaurants.

|

Batching CocktailsYou may have heard that batching of cocktails is now legal in Wisconsin. 2023 Wisconsin Act 73 changes current law to legalize and regulate batching of cocktails.

|

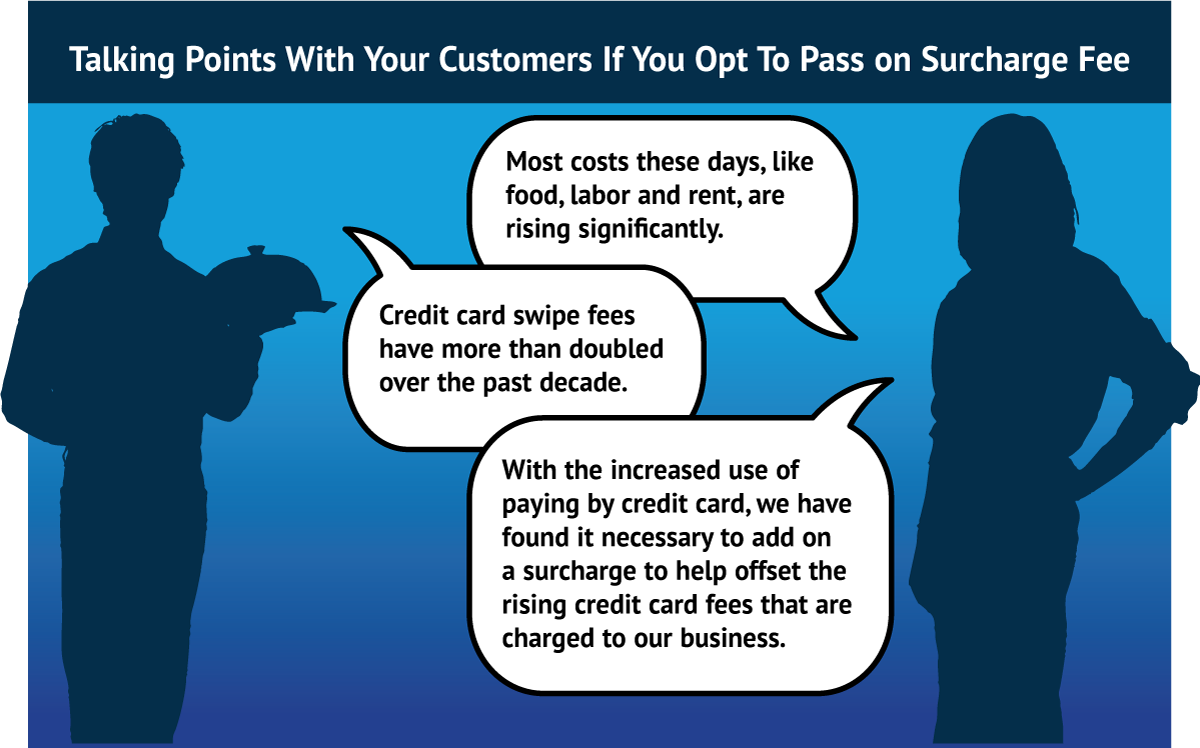

FAQs on Surcharges, Convenience Fees & Cash DiscountsOver the last few years, as food, labor and property costs have increased, the trend of surcharging has emerged to help offset the cost of accepting credit cards. But what some merchants don’t know is that there are specific rules regarding surcharges that need to be followed. And there are serious consequences for not following them.

|

|

Question: I am hiring a 17 year old who has already graduated from high school. What are her hour restrictions?

Answer: 16- or 17-year-old who has graduated from high school may be employed during the same hours, and as many hours, as an adult. However, all other teen labor restrictions for her age group (not serving alcohol, not using a meat slicer, breaks, etc.) still apply. |

Straw Use OrdinancesThree Wisconsin municipalities now have straw use laws: Madison, Milwaukee and Wauwatosa.

|

Handling Property DamageSuggestions and tips to begin yet another road to recovery.

|

Scams Targeting RestaurantsResourceful con artists are always coming up with new ways to fleece money from people. Some scams seem perfectly designed to take advantage of restaurant operators—since it is a restaurant owner’s nature to be a hospitable and welcome new business.

|

Sick Employee PolicyMake sure your employees know that the Wisconsin Food Code requires them to inform the manager on duty if they are ill with certain types of symptoms or illnesses.

|

Popular Topics FAQs

Alcohol

Are there any circumstances where a patron who is under 21-years-old could drink alcohol in a bar or restaurant?

An underage person (under 21) can drink if accompanied by a parent, guardian or spouse of legal drinking age. Some people question whether this exception still applies to people ages 18-21. Parental rights do not cease at age 18, a parent is still a parent whether their child is 17 or 71. So an 18-, 19- or 20-year-old can drink with their parent, guardian or spouse of legal drinking age.

However, an establishment can have a policy not to serve anyone under 21 even if they are with their parent, guardian or spouse of legal drinking age. If this is the policy, it must be enforced the same for everyone.

However, an establishment can have a policy not to serve anyone under 21 even if they are with their parent, guardian or spouse of legal drinking age. If this is the policy, it must be enforced the same for everyone.

Is a restaurant able to buy a small quantity of alcohol from a liquor store to sell in the restaurant?

No. Wisconsin state statute requires retailers to purchase alcohol from a Wisconsin wholesaler. No exceptions. You must have an invoice for all purchases of liquor, wine and beer. And you may only purchase alcohol from a Wisconsin wholesaler. Refer to Publication 302, section XIII.

Can I sell mixed drinks in a covered and packaged container made by our restaurant/bar?

Yes. Restaurants can sell craft cocktails and wine by the glass to customers for carryout. The cocktails to go law went into effect on March 28, 2021. WRA advocated for this measure for over 10 months in 2020 and 2021 and we are pleased that this is now an option for restaurants. Cocktails sold to go must be in a tamper evident seal. Your normal soda cup and lid with a straw hole is not allowed. To use a plastic cup and lid, you need to use a lid with NO straw holes and secure the lid with strong tape. You should securely seal cocktails with heat seal bands, strong tape/stickers, or invest in jars and pouches specifically created for to go beverages that need to be sealed.

Employee Management/Wages/Hours

Can an employee quit and demand that a final paycheck is provided right away?

No. When an employee quits, you don’t need to pay them immediately, cut a special payroll check or make other special arrangements. Just make sure the employee receives their last paycheck no later than the next regularly scheduled payday.

Is it possible for a tipped employee to have a zero paycheck?

Yes, if tipped employees are paid out their cash tips at the end of each shift, they are taking home their GROSS wages… wages that still need to be taxed. This can create a shortfall of funds when all taxes need to be withheld on all gross income depending on the amount of tips earned.

The issue is compounded if credit card tips are paid out at the end of each shift which is one reason why it is recommended that charge tips be paid out via payroll.

The issue is compounded if credit card tips are paid out at the end of each shift which is one reason why it is recommended that charge tips be paid out via payroll.

Are restaurants allowed to deduct credit card processing fees from servers' charged tips?

Credit card processing fees can be deducted from servers’ charged tips. For example, where a credit card company charges an employer 3 percent on all sales charged to its credit service, the employer may pay the tipped employee 97 percent of the tips without violating the Fair Labor Standards Act (FLSA).

Keep in mind, this charge on the tip may not reduce the employee’s wage below the required minimum wage. It is also important to consider the impact and perceptions of your employees should you wish to deduct credit card fees from their charged tips.

Keep in mind, this charge on the tip may not reduce the employee’s wage below the required minimum wage. It is also important to consider the impact and perceptions of your employees should you wish to deduct credit card fees from their charged tips.

|

Scroll down to Credit Cards section

|

Food Code

What illnesses are my restaurant employees required to report to management?

In addition to the foodborne illnesses, (Norovirus, Hepatitis A virus, Shigella spp., Shiga toxin-producing Escherichia Coli, (e.g. E. coli 0157:H7) Typhoid fever (caused by Salmonella Typhi); or Salmonella (nontyphoidal)), the Wisconsin Food Code requires employees to inform the manager on duty if he/she is ill with the following: diarrhea, vomiting, jaundice, sore throat with fever, wound or boil that contains pus on exposed skin or it they are living with a household member diagnosed with a foodborne illness—or living with a household member attending or working in a setting where there has been a confirmed foodborne illness outbreak or had Typhoid fever, diagnosed by a health practitioner within the past 3 months without having received antibiotic therapy, as determined by a health practitioner.

Download the English and/or Spanish poster here.

Download the English and/or Spanish poster here.

Can a restaurant make croutons or breadcrumbs out of the uneaten rolls that get returned to the kitchen in bread baskets?

No. You cannot re-use food that came in contact with customers, even if it appears to have been untouched. The Wisconsin Food Code specifies that “after being served or sold and in the possession of a consumer, food that is unused or returned by the consumer may not be offered as food for human consumption.

Are certified food manager certification classes held in person or online?

WRA hosts both online and in-person ServSafe review sessions to help prepare you for taking the ServSafe Certified Food Protection Manager proctored exam. You can take the exam at the in-person review sessions or arrange for an online proctored exam.

More Info / Register for ServSafe Manager Online Bundle or Live Review Session

More Info / Register for ServSafe Manager Online Bundle or Live Review Session

Operations

Does Wisconsin really have a "Butter Law" or is this just urban legend?

There is indeed a butter law here in America’s Dairyland! Stat. 97.18(4) states, “The serving of colored oleomargarine or margarine at a public eating place as a substitute for table butter is prohibited unless it is ordered by the customer.”

You may use margarine for baking and cooking without first getting customer’s permission. However, you should be aware that the butter/spreads you put out on the table must be pure butter or a mix of individually packaged butter and margarine “reddies” (with the majority being butter).

Also, the butter must be graded via the Wisconsin grading program. Imported butter that has not gone through the DATCP grading system cannot be sold in Wisconsin.

You may use margarine for baking and cooking without first getting customer’s permission. However, you should be aware that the butter/spreads you put out on the table must be pure butter or a mix of individually packaged butter and margarine “reddies” (with the majority being butter).

Also, the butter must be graded via the Wisconsin grading program. Imported butter that has not gone through the DATCP grading system cannot be sold in Wisconsin.

Are there any restrictions to making additional employees delivery drivers?

You will need to check with your insurance carrier regarding what steps need to be completed. Know that minors are not allowed to do much with delivery.

What is a normal insurance requirement for food delivery drivers?

Any employee using their own automobile for deliveries should make sure their own automobile insurance covers them for liability in the unlikely event an accident happens. If you are having employees deliver as part of your business plan, you must contact your insurance broker. At minimum, you as the business owner MUST have non-owned and hired automobile coverage added to your package policy and/or automobile policy.

Here are the general rules most insurance companies will enforce:

Protect yourself and your business. Reach out to your trusted broker to have the proper coverage added to your policy BEFORE it’s too late.

Here are the general rules most insurance companies will enforce:

- Drivers must have valid driver’s license with minimum three years licensed driving experience.

- Ask driver if they have had any violations or accidents in the last three years—two minor violations may be acceptable. If any more violations than that, do not let them drive.

- Ask driver if they have any major violations in last five years such as DUI, speeding in excess, reckless driving or any suspension or revocation. If the driver cannot answer no, than this is a red flag and driving for your business should not be allowed.

- If you want employee to use own vehicles, remind drivers that their personal insurance will pay first.

- Get a copy of driver’s current auto declaration page—many personal auto policies have exclusions for delivery.

- The employee should verify coverage for delivery. If no coverage on personal policy, don’t let them drive for your business.

- If employee is assigned to driving duties, you should add work comp classification code 7380 to your work comp policy as well. The rate set by the State is $6.37 per hundred dollars of payroll for each employee driving.

Protect yourself and your business. Reach out to your trusted broker to have the proper coverage added to your policy BEFORE it’s too late.

I hook up my iPhone to speakers and play a mix of music in our restaurant. Is this OK to do and not pay fees to other companies?

No, using your phone or another device like an MP3 player doesn't mean you won't need to pay performing rights organizations (PROs) such as BMI, ASCAP, SESAC and GMR. These PROs serve as clearinghouses between the creators and the owners of copyrighted music, and those who want to publicly play this music. When you download music to your devise and pay for the song, that price covers only the right for you to listen privately, not when you play the song in public. When you play a song in public (live or from your device) it becomes a public performance.

Are there exemptions? Yes, read more in Members Only under Topics and Resources - Music Licensing or click here for WRA's music licensing Q&A.

BMI offers WRA members a discount on the fees. Reach out to BMI at https://www.bmi.com/licensing or call (800) 925-8451.

Are there exemptions? Yes, read more in Members Only under Topics and Resources - Music Licensing or click here for WRA's music licensing Q&A.

BMI offers WRA members a discount on the fees. Reach out to BMI at https://www.bmi.com/licensing or call (800) 925-8451.

What questions am I allowed to ask a customer who brings a service animal into the restaurant?

Only dogs and miniature horses are approved as service animals. When it is not obvious what service an animal provides, only limited inquiries are allowed. There are only two questions you may ask: (1) is the animal (dog or miniature horse) a service animal required because of a disability, and (2) what work or task has the animal (dog or miniature horse) been trained to perform. Staff cannot ask about the person’s disability, require medical documentation, require a special identification card or training documentation for the animal, or ask that the animal demonstrate its ability to perform the work or task.

Is it OK to ask customers to hold their reservation with a credit card number and charge them a fee if they don’t show up?

You can ask customers for a deposit or credit card number to hold a reservation. However, you must inform customers of this policy in advance so they understand that they will be charged a set amount on their credit card or forfeit their deposit if they do not show up for their reservation. This tactic could annoy some customers so you may want to consider doing it only on very busy special occasions or holidays such as graduation, Mother's Day, Valentine's Day, etc...

If you do decide to take their credit card number for a reservation, make sure you get their name, expiration date and CVC number from the credit card and remember to confirm that they are clear on your policy so they will be less likely to dispute the charge when it appears on their next credit card statement. You should know that while some customers may pay the fee if they fail to show, others may claim to their credit card company that they knew nothing about the charge. Without the customer's signature in a charge-back dispute, you would most likely come out on the losing side. Another thing you may want to consider is keeping a waiting list of interested customers so you can call them at the last minute and offer a table when guests with reservations fail to show or cancel their reservations.

If you do decide to take their credit card number for a reservation, make sure you get their name, expiration date and CVC number from the credit card and remember to confirm that they are clear on your policy so they will be less likely to dispute the charge when it appears on their next credit card statement. You should know that while some customers may pay the fee if they fail to show, others may claim to their credit card company that they knew nothing about the charge. Without the customer's signature in a charge-back dispute, you would most likely come out on the losing side. Another thing you may want to consider is keeping a waiting list of interested customers so you can call them at the last minute and offer a table when guests with reservations fail to show or cancel their reservations.

Taxes & Records

My host has been helping with to go orders lately and is making tips. Do they have to report those tips, even though they are paid above minimum wage?

Employees who receive $20 or more in tips must report 100% of their tips and pay taxes on them, even when they are being paid full minimum wage or more.

What forms need to be completed for all new hires when onboarding?

An employee should complete the following forms I-9, WT-4, W4, Affordable Care Act (ACA) notification; along with a food safety training sign off sheet and a tip credit notification when necessary, which can be found online in the members only resources or reach out to the AskWRA Team for more information. Email or call 608.270.9950.

Teen Labor

Is it legal for the parent of a teen employee to pick up their child's paycheck?

The parent is the guardian of the minor and has control over the check and can, therefore, pick up their child’s paycheck (unless the teen is an emancipated minor).

Do restaurants need to have a work permit on file for 16- and 17-year-old employees?

Not any longer. As of June 2017, Wisconsin law changed and therefore 16- and 17-year-old minors are no longer required to obtain a work permit.

Keep in mind, 14- and 15-year-old employees still need to obtain a work permit prior to starting work.

Keep in mind, 14- and 15-year-old employees still need to obtain a work permit prior to starting work.

Can teens work more hours if they have a partial week of school due to a school in-service day, parent conferences or holiday break?

No. The Department of Workforce Development indicates that employees under the age of 16 can only work up to 18 hours during a school week, even if there’s only one school day in the school week. If there is no school the entire week, then employees under age 16 can work up to 40 hours.

Reminder: make sure to be mindful of required breaks for all staff under age 18.

Reminder: make sure to be mindful of required breaks for all staff under age 18.

Didn't find what you were looking for? |

Member Benefits

Hand WashingHandwashing is the most effective means of preventing the spread of bacteria and viruses and can prevent contamination of food, utensils and equipment.

|

Employee Engagement PlaybookThe latest stats, resources, best practices, peer-to-peer advice and some budget friendly suggestions to help restaurants engage with employees and create a more positive workplace culture.

|

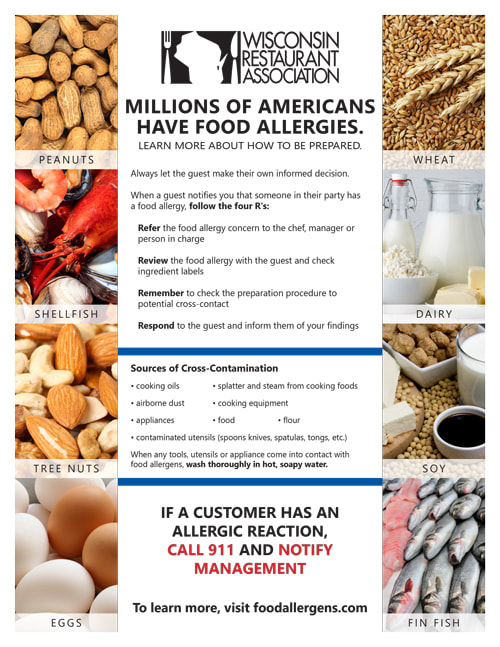

Allergen Awareness PosterThe Wisconsin Restaurant Association developed a free poster to help restaurants inform their staff and customers about food allergies.

|

Social Media Crisis KitIt’s a new landscape for businesses because of the incredible power that social media wields these days. Many restaurant owners have told us that they feel unequipped to deal with these situations.

|

Employee's Record FileWRA wants to help you get (and stay) organized and make sure you’re in compliance with recordkeeping requirements. We’ve created these personnel files as another valuable member benefit.

|

Do you still have questions not answered here? |