|

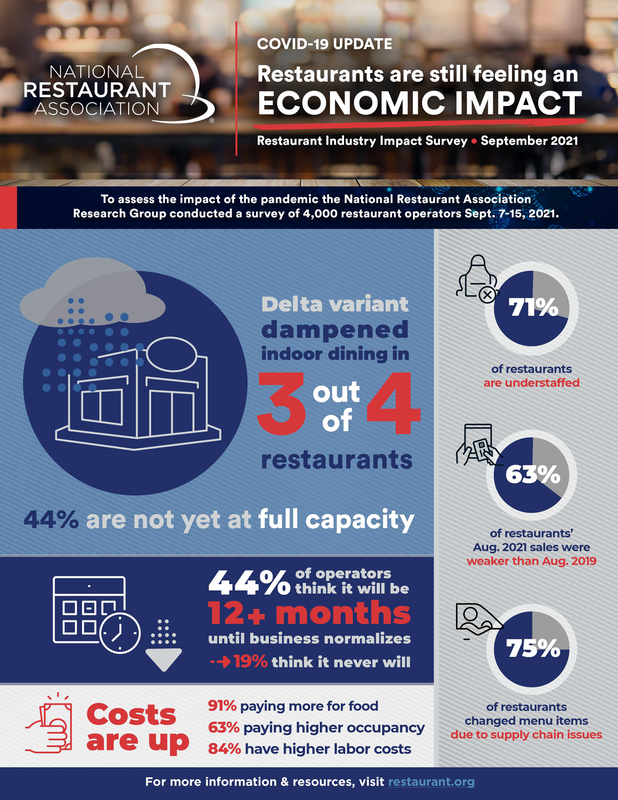

The National Restaurant Association recently released results from a survey of 4,000 restaurant operators taken from September 7-15, 2021. The results indicate that the delta variant dampened dining in 3 out of 4 restaurants and 44% of restaurant operators believe it will take more than a year for business normalize. 91% are paying more for food. 63% are paying higher occupancy. 84% have higher labor costs. See graphic on this page for more details.

0 Comments

Congressional tax writers are considering a number of tax increases in the $3.5 trillion budget reconciliation bill that is being negotiated among Congressional Democrats this week. The National Restaurant Association and the Wisconsin Restaurant Association have been working with moderate members of Congress who will play a critical role in passing the bill, to educate them on the detrimental impact tax increases would have on the restaurant industry still struggling to recover from the pandemic. In a letter to House and Senate leaders, the National Restaurant Association opposed:

$540 billion. As the second-largest private sector employer in the nation, restaurants will have fewer opportunities to invest in employee growth and expansion. If passed, most of the proposed changes will take effect in January 2022. “Raising taxes during a pandemic creates unintended consequences for a restaurant’s prospects for survival, the growth of our workforce, and the recovery of the communities we serve,” said Kristine Hillmer, WRA President and CEO. “It would be tragic if Congress provided a lifeboat for restaurants and other small businesses via the Paycheck Protection Program, Employee Retention Tax Credit, and the Restaurant Revitalization Fund, only to sink these same businesses with a major tax hike while a full recovery remains out of sight.”

Recently, the US Small Business Administration (SBA) announced new flexibilities and enhancements for the COVID-19 Economic Injury Disaster Loans (EIDL) program. The COVID-19 EIDL program provides 30-year loans with fixed interest rates of 3.75% for eligible businesses. The National Restaurant Association has been working with the SBA to make improvements to EIDL. These improvements include:

The National Restaurant Association is hosting a webinar with the SBA on the EIDL enhancements on September 15th at 1:00 pm (CT). Tips on How to Reduce Turnover by Becoming a Preferred Employer in the Hospitality Industry9/2/2021

|

Archive

July 2024

Categories |

|

©Copyright Wisconsin Restaurant Association. All Rights Reserved.

2801 Fish Hatchery Rd | Madison, WI 53713 Tel: 608.270.9950 | [email protected] | sitemap | terms | privacy |

RSS Feed

RSS Feed